https://creditospresta.com/dispon-Que- Es-Tipos-De-Prestamo-Condiciones, Advantages & More

Introduction to https://creditospresta.com/dispon-Que- Es-Tipos-De-Prestamo-Condiciones

In today’s dynamic financial landscape, obtaining a loan can be a critical solution for meeting various personal and business needs. Whether you’re considering a new car, funding education, or managing unexpected expenses, understanding the types of loans available and their conditions is essential. This article explores the concept of “dispon,” the different types of loans, their benefits, and the conditions associated with each type.

What is Dispon?

“Dispon” refers to the availability or accessibility of funds through loans. In many financial contexts, it indicates a state where individuals can obtain money quickly and efficiently, typically through various types of credit offerings. Understanding how dispon works can empower borrowers to make informed financial decisions.

The Importance of Dispon in Financial Management

Dispon plays a crucial role in financial management as it determines how quickly and easily individuals can access funds. For those facing urgent expenses, the ability to obtain a loan with favorable conditions can alleviate financial stress. Recognizing the types of loans available and their specific conditions can help borrowers navigate their options effectively, ensuring they choose the right financial product for their needs.

Types of Loans

Loans can be categorized into several types, each serving different purposes and coming with its own set of conditions. Below are some common types of loans available to consumers:

1. Personal Loans

Personal loans are versatile loans that individuals can use for various purposes, including consolidating debt, financing a vacation, or covering unexpected medical expenses. They typically have fixed interest rates and are paid back in installments over a specified period.

Key Features:

- Loan Amount: Varies based on creditworthiness, typically ranging from $1,000 to $50,000.

- Repayment Terms: Usually between 1 to 5 years.

- Interest Rates: Fixed or variable rates, often lower than credit cards.

Advantages:

- Flexibility in use.

- Predictable monthly payments.

Considerations:

- Borrowers need a good credit score to secure favorable terms.

2. Home Equity Loans

Home equity loans allow homeowners to borrow against the equity built up in their property. This type of loan is secured by the home, meaning that the house acts as collateral.

Key Features:

- Loan Amount: Typically 80% to 90% of the home’s equity.

- Repayment Terms: Generally ranges from 5 to 30 years.

- Interest Rates: Often lower than personal loans due to being secured by the property.

Advantages:

- Lower interest rates compared to unsecured loans.

- Possible tax deductions on interest paid.

Considerations:

- Risk of foreclosure if payments are not made.

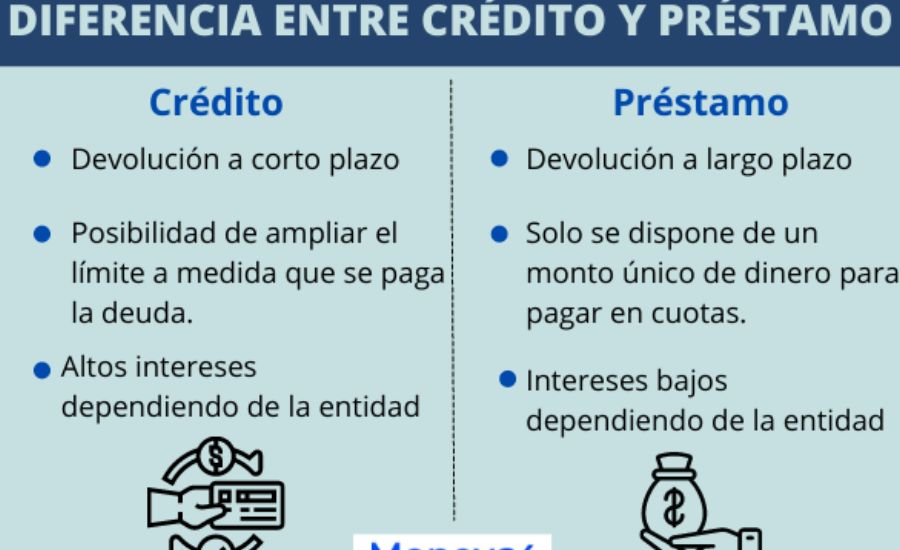

3. Credit Cards

While not traditional loans, credit cards allow individuals to borrow money up to a certain limit for purchases. They are a form of revolving credit, meaning borrowers can pay off their balance and borrow again.

Key Features:

- Credit Limit: Varies by issuer and creditworthiness.

- Repayment Terms: Minimum monthly payments, typically requiring the balance to be paid in full to avoid interest charges.

- Interest Rates: Variable rates, usually higher than personal loans.

Advantages:

- Convenient for everyday purchases.

- Rewards programs and cashback opportunities.

Considerations:

- High-interest rates if balances are not paid in full.

4. Auto Loans

Auto loans are specifically designed to help individuals purchase vehicles. They can be obtained through banks, credit unions, or dealerships and are secured by the vehicle itself.

Key Features:

- Loan Amount: Typically based on the vehicle’s price.

- Repayment Terms: Usually between 3 to 7 years.

- Interest Rates: Often lower than personal loans, especially for new cars.

Advantages:

- Lower rates due to the loan being secured.

- Fixed monthly payments.

Considerations:

- Vehicle depreciation can affect the overall financial picture.

5. Student Loans

Student loans are designed to help cover the cost of education, including tuition, fees, and living expenses. They can be federal or private loans, with different terms and repayment options.

Key Features:

- Loan Amount: Varies based on educational needs.

- Repayment Terms: Typically 10 to 30 years.

- Interest Rates: Generally lower for federal loans, with options for deferment.

Advantages:

- Access to funds for education without immediate repayment requirements.

- Potential for loan forgiveness programs.

Considerations:

- Federal loans have specific conditions and limits on borrowing.

6. Payday Loans

Payday loans are short-term loans designed to provide immediate cash before the borrower’s next paycheck. These loans often come with high-interest rates and should be approached with caution.

Key Features:

- Loan Amount: Usually between $100 to $1,000.

- Repayment Terms: Typically due on the borrower’s next payday.

- Interest Rates: Extremely high compared to traditional loans.

Advantages:

- Quick access to cash in emergencies.

Considerations:

- Risk of falling into a cycle of debt due to high fees.

Conditions Associated with Loans

Each type of loan comes with specific conditions that borrowers must meet to qualify. Here are some common conditions to consider:

1. Credit Score

Most lenders evaluate a borrower’s credit score to determine their creditworthiness. A higher score often results in better interest rates and terms.

2. Income Verification

Lenders typically require proof of income to ensure borrowers can meet their repayment obligations. This can include pay stubs, tax returns, or bank statements.

3. Debt-to-Income Ratio (DTI)

The DTI ratio measures a borrower’s total monthly debt payments against their gross monthly income. A lower DTI indicates better financial health and may increase the likelihood of loan approval.

4. Collateral

Secured loans require collateral, such as a home or vehicle, to mitigate the lender’s risk. If the borrower defaults, the lender can seize the collateral.

5. Loan Purpose

Some lenders may restrict loan use to specific purposes, such as home improvements or educational expenses.

6. Loan Term Length

The repayment period can significantly affect monthly payments and the overall cost of the loan. Shorter terms typically result in higher monthly payments but less interest paid overall.

Benefits of Loans

Understanding the benefits of loans can help borrowers make informed decisions. Here are some advantages of obtaining a loan:

1. Immediate Access to Funds

Loans provide quick access to cash for emergencies or significant purchases, helping individuals manage unexpected expenses effectively.

2. Improving Credit Score

Timely repayments can positively impact credit scores, making it easier to secure future loans with better terms.

3. Budgeting and Planning

Fixed repayment schedules allow borrowers to budget more effectively, as they know exactly what their monthly obligations will be.

4. Financial Flexibility

Loans enable individuals to finance large purchases that they may not afford upfront, spreading the cost over time.

Challenges of Loans

While loans can be beneficial, there are also challenges associated with borrowing. Understanding these challenges can help borrowers navigate their financial obligations more effectively.

1. Interest Rates and Fees

High-interest rates, particularly for unsecured loans and payday loans, can lead to significant repayment amounts over time.

2. Risk of Over-Borrowing

The ease of obtaining loans may tempt individuals to borrow more than they can afford, leading to financial strain.

3. Potential for Debt Cycle

Short-term loans with high-interest rates can trap borrowers in a cycle of debt, where they continuously take out new loans to pay off previous ones.

4. Impact on Credit Score

Missing loan payments or defaulting can negatively affect credit scores, making it more challenging to secure future financing.

Conclusion

Understanding the different types of loans available and their conditions is vital for anyone considering borrowing money. Whether for personal needs, education, or business purposes, being informed allows individuals to make smart financial decisions.

While loans can provide immediate access to funds and help manage financial obligations, it’s essential to assess personal circumstances and choose the right loan type. Always consider the interest rates, repayment terms, and potential risks before committing to a loan.

In a world where financial needs can arise unexpectedly, having access to various loan options with clear terms can make all the difference. By carefully considering your financial situation and exploring the various types of loans available, you can navigate your borrowing needs effectively and make informed choices for a more secure financial future.

Frequently Asked Questions (FAQs)

1. What is “dispon”?

- Dispon refers to the availability or accessibility of funds through loans. It indicates how quickly individuals can obtain money through various types of credit offerings.

2. What are the main types of loans available?

- The main types include personal loans, home equity loans, credit cards, auto loans, student loans, and payday loans. Each type serves different purposes and comes with its own conditions.

3. What factors affect loan eligibility?

- Key factors include credit score, income verification, debt-to-income ratio, collateral, and the intended use of the loan. Lenders assess these to determine creditworthiness and loan terms.

4. What are the benefits of obtaining a loan?

- Loans provide immediate access to funds, help improve credit scores with timely repayments, allow for better budgeting, and offer financial flexibility for large purchases.

5. What challenges do borrowers face when taking out loans?

- Borrowers may encounter high-interest rates, the risk of over-borrowing, potential debt cycles from short-term loans, and negative impacts on their credit score if payments are missed.

6. How can borrowers choose the right type of loan?

- Borrowers should assess their financial situation, consider interest rates, repayment terms, and their specific needs to select the most suitable loan option.

Key Facts

- Personal Loans: Versatile, can be used for various purposes; loan amounts range from $1,000 to $50,000; repayment terms are generally between 1 to 5 years.

- Home Equity Loans: Secured by the home; allows borrowing against home equity; interest rates are typically lower than unsecured loans.

- Credit Cards: Offer revolving credit; require careful management to avoid high-interest debt; often come with rewards programs.

- Auto Loans: Specifically for purchasing vehicles; secured by the car itself, which lowers interest rates.

- Student Loans: Help cover education costs; can be federal or private, with different repayment options and potential for forgiveness.

- Payday Loans: Short-term loans for immediate cash; come with very high-interest rates and should be approached with caution due to the risk of debt cycles.

Read More Information About Blog At discoverparadox